#Invoice factoring vs line of credit plus#

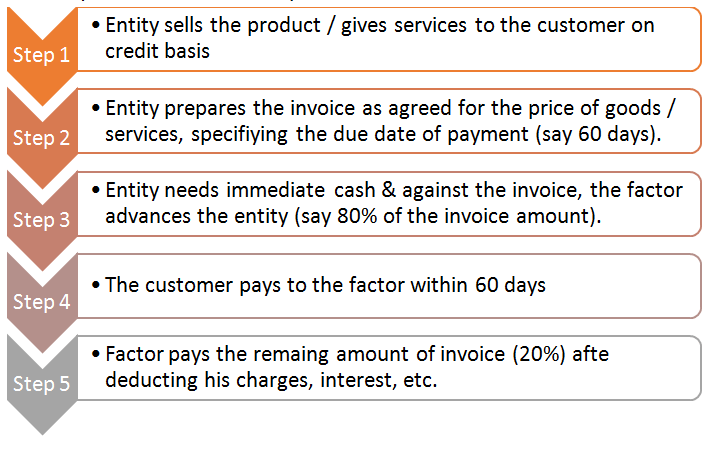

The factor pays the shipping company and recoups the money plus a small profit by buying the invoices. Unpaid invoices are essential collateral. What Are the Differences Between a Freight Factoring Company and a Factoring Service Bank?īoth freight factoring companies and banks that offer the service operate in the same way. Being paid immediately upon delivery of goods ensures solid cash flow. This increases a company’s debt and eats into profits. They may need to use lines of credit or take out bank loans to meet monthly expenses. For a small shipping business, this waiting period can wreak havoc with finances. Payment on invoice typically takes anywhere from 30-90 days or more. After all, wouldn’t a trucking company prefer to collect the entire sum of an invoice? The reduction in price offered to the factor is small and well worth its intention. What Are the Advantages of Freight Factoring?Īt first glance, freight factoring may seem like an unnecessary expense. The shipper collects the sale price and the factor waits for payment from the customer. The invoices are sold at a slight discount. A shipping company will sell its invoices to a third-party company or bank, called a factor. One that is growing in popularity and proving effective is freight factoring.įreight factoring is also known as trucking factoring or transportation factoring.

There are several ways to manage invoices. In addition to quality vehicles, personnel, buildings, and other equipment, invoicing effectively for prompt payment is an essential factor. Owing a trucking company can be lucrative but like any other business, it must be managed well. There is plenty of freight of all shapes and sizes that need to be moved around the country. The shipping industry is vital to businesses of all kinds as well as consumers.

0 kommentar(er)

0 kommentar(er)